Avanse Login: Key to Seamless Education Financing Solutions

In a world where higher education is essential yet costly, Avanse Financial Services provides a reliable solution to help students and families finance their educational goals. By using the Avanse login platform, users can access a comprehensive suite of tools designed to manage, apply for, and track educational loans effectively. This article will guide you through what Avanse offers, its features, benefits, and security measures to keep in mind while accessing the Avanse login portal.

What is Avanse?

Avanse Financial Services Limited is a Non-Banking Financial Company (NBFC) based in India that specializes in education loans for students pursuing higher education domestically and internationally. Avanse aims to make education accessible to students from all walks of life, whether they’re seeking technical training, undergraduate degrees, postgraduate education, or advanced professional certifications.

Avanse offers a range of tailored financial products, from student loans to study abroad funding and skill-enhancement financing. Through Avanse login, students, parents, and guardians can easily manage loans, track application status, and make payments online, all from one platform.

Features of Avanse

The Avanse login platform is packed with features that simplify education financing for users, making it easy to manage every aspect of the loan process digitally. Here’s a look at some of the primary features that Avanse offers:

- Easy Loan Application Process

- Through Avanse login, users can apply for loans directly from the platform. The online application process is user-friendly, guiding applicants through every required detail to ensure that applications are submitted accurately and promptly.

- Customizable Loan Options

- Avanse offers flexible financing options. Students can choose loan products that cover tuition, living expenses, travel, and other associated costs. Avanse login allows users to explore loan terms and select the plan that best suits their needs.

- Instant Loan Tracking

- After applying, users can track their loan application status in real-time. Through Avanse login, students can view updates on approvals, disbursements, and repayments, ensuring complete transparency in the loan process.

- Payment and EMI Management

- The Avanse login dashboard enables users to manage loan repayments, check EMI schedules, and make payments directly on the platform, making it easier to stay on top of financial obligations.

- Loan Calculator

- Avanse provides a loan calculator within the platform, accessible via Avanse login. Users can estimate their loan amount, interest rate, EMI, and repayment tenure, helping them understand and plan their financial commitments.

- Customer Support

- Avanse offers dedicated customer support to help users with queries regarding loan products, eligibility, repayments, and more. Through Avanse login, users can access support options like live chat and email support to resolve any issues quickly.

Benefits of Avanse

There are several reasons why students and families choose Avanse login for education financing. Here are some of the significant benefits:

- Flexible Financing Options

- Avanse provides customized loan plans that cover a range of educational expenses, from tuition and accommodation to study materials and travel. By using Avanse login, users can easily select loan plans that align with their academic and financial needs.

- Quick and Transparent Loan Processing

- Avanse is known for its efficient loan processing. With Avanse login, applicants experience faster approval times, allowing students to focus on their studies rather than worrying about funding delays.

- Competitive Interest Rates

- Avanse offers competitive interest rates for education loans. Additionally, students can use the Avanse login platform to calculate their loan EMI and interest payments, which promotes financial planning and transparency.

- Comprehensive Coverage for Study Abroad

- Avanse provides financial support for students aiming to study abroad, covering not just tuition but also living expenses, travel, and other essentials. With Avanse login, international students can monitor and manage their loans no matter where they are.

- Accessibility and Convenience

- The Avanse login platform is accessible 24/7, allowing students and families to manage loans from any location. The platform’s ease of access and functionality make it highly convenient for users.

- Expert Financial Guidance

- Avanse offers advisory services that help users make informed financial decisions. Through Avanse login, users can access expert guidance tailored to their educational and financial circumstances.

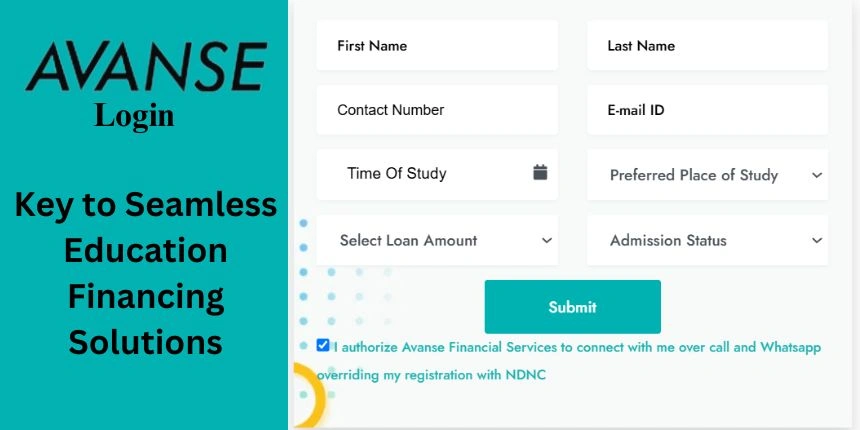

Step-by-Step Guide to Sign Up on the Avanse Platform

- Visit the Avanse Website

- Go to the official Avanse website and look for the Sign Up option, usually available on the homepage or under the login area.

- Choose Sign-Up Option

- You may need to select “New User” or “Apply for a Loan” if you’re beginning a loan application. This step may redirect you to a registration form.

- Fill Out the Registration Form

- Provide basic personal details, such as your full name, email address, mobile number, date of birth, and nationality. You may also need to provide educational details and the purpose of your loan if you’re signing up for an education loan account.

- Create Login Credentials

- Set a username (often your email) and a password. Ensure that your password is strong, using a mix of letters, numbers, and symbols for security.

- OTP Verification

- After entering your details, Avanse may send a One-Time Password (OTP) to your registered mobile number or email. Enter this code to verify your account and complete the sign-up process.

- Agree to Terms and Conditions

- Carefully read and accept Avanse’s terms and conditions, and then click Sign Up or Create Account.

- Account Confirmation

- Once your details are verified, you’ll receive a confirmation message, and your account will be created. You can now proceed with the Avanse login.

Step-by-Step Guide to Avanse Login

- Go to the Avanse Login Page

- Visit the Avanse website, and select the Login option, usually located in the top right corner of the homepage.

- Enter Your Username and Password

- Use the username (or email) and password you set up during registration. Ensure that you enter the credentials correctly to avoid login issues.

- OTP Authentication (If Enabled)

- For added security, Avanse might use two-factor authentication (2FA), sending an OTP to your registered email or mobile number. Enter this OTP if prompted.

- Click “Login”

- After entering your details, click the Login button. You’ll be redirected to your account dashboard, where you can access loan services, payment options, and account settings.

Features Available After Avanse Login

- Track Loan Status: Check application status, pending approvals, and disbursement updates.

- Manage Repayments: View upcoming payments, repayment schedules, and make payments directly.

- Update Account Details: Update contact information, email addresses, and bank details as needed.

- Contact Support: Reach out to Avanse’s customer support team for assistance with any loan-related queries or issues.

Security Tips for Avanse Login

Given the sensitivity of financial data, users should prioritize security when accessing their Avanse login. Here are some key security tips to ensure safe access:

- Use Strong Passwords

- When creating your Avanse login credentials, use a unique password that combines letters, numbers, and special characters. Avoid using easily guessed information like birthdates or simple sequences.

- Enable Two-Factor Authentication (2FA)

- If available, enable two-factor authentication for an added layer of security. 2FA requires an additional verification code sent to your mobile or email, ensuring that only authorized users can access the account.

- Keep Login Details Private

- Never share your Avanse login username or password with anyone. Avoid writing down credentials or storing them in unsecured locations.

- Avoid Public Wi-Fi for Logins

- Refrain from using public Wi-Fi networks when accessing your Avanse login account, as these networks are less secure and can expose your account to hacking attempts. Opt for a secure, private network instead.

- Regularly Update Passwords

- Periodically changing your Avanse login password can prevent unauthorized access. Consider updating your password every few months for added security.

- Always Log Out

- If you’re using a shared or public computer, be sure to log out of your Avanse login account once you’re finished. Logging out ensures that others won’t be able to access your account if they use the same device.

Conclusion

Avanse has established itself as a reliable partner for students seeking education financing, and the Avanse login platform enhances this experience by providing easy access to loan management tools and support resources. From streamlined loan applications to real-time loan tracking and secure payment options, the Avanse login platform is designed to make education financing manageable and transparent for all users. By following recommended security practices, users can safely navigate their accounts and maximize the benefits of Avanse’s offerings.